The Most

Efficient

DEX

Powered by AI

Groundbreaking Financial Engineering.

Revolutionary AI Agents.

Lowest Trading Costs.

Highest LP Returns.

$VAI

Symbol

1,000,000,000

Total Supply

Burned

Liquidity Pool

Renounced

VAI Ownership

VelocityAI is an innovative DEX addressing a large and neglected market segment: trading in smaller-cap assets outside the top 5.

In many cases, there is no direct liquidity between such assets, and trades need to go through a 3rd asset (WETH, USDC, etc.). This results in double trading fees, double gas fees and double price impact.

Those trades account for over 20% of total DEX trading volume, and losses from indirect trading sum up to hundreds of millions of dollars.

VelocityAI ’s innovative reserve-based virtual pools solve the problem, making any trade direct, and saving all the redundant fees.

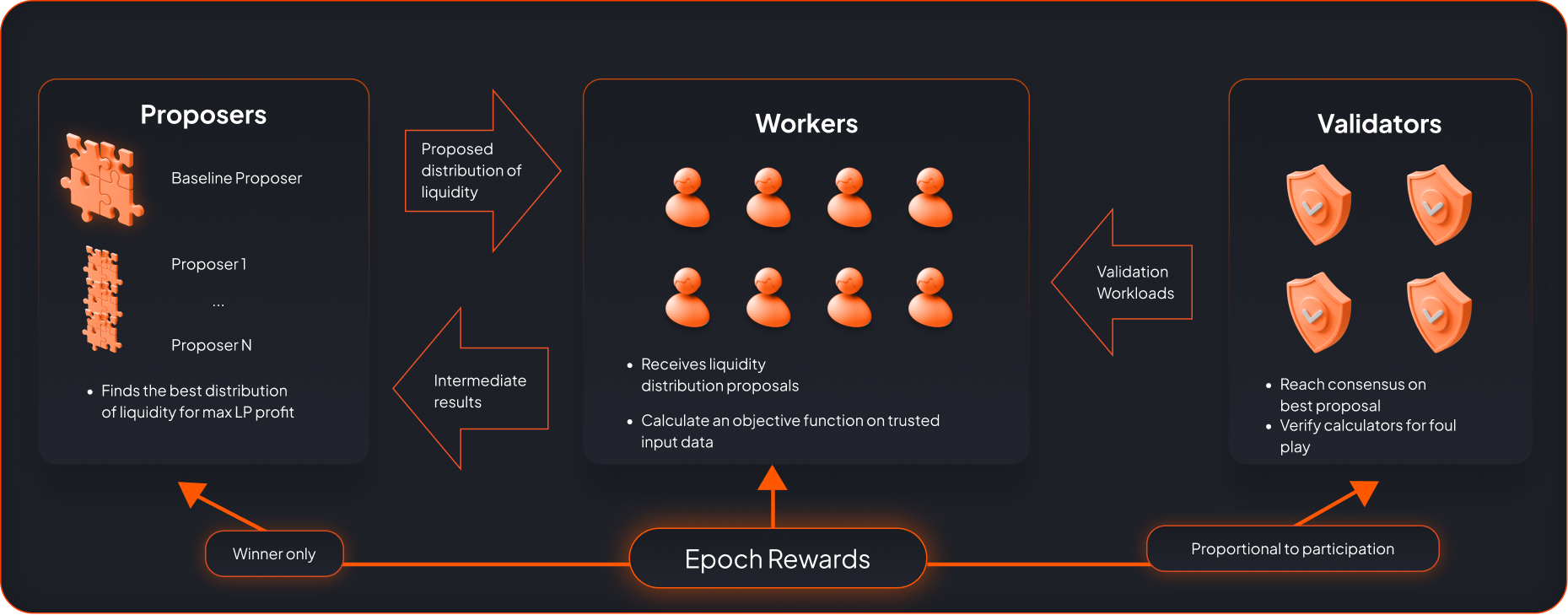

In addition, VelocityAI AI Governance optimally distributes the liquidity between pools according to the current market conditions, to reach best results for both traders and LPs.

Inefficient indirects trades with

99 Percent Assets

Trades between Stablecoins

Trades in WETH, WBTC and Stablecoins

“VelocityAI is for 99% of assets what Curve is for stablecoins”

“VelocityAI is a pioneer in DEX AI agents”

VelocityAI stands out in the DEX landscape. Its pools operate harmoniously with the aim of maximizing the available liquidity for each trade.

This is achieved via an innovative reserve-based pool architecture that enables risk-free liquidity sharing.

$VAI is a key part of the ecosystem. $VAI is a deflationary token, and is distributed to the community over 10 years by rewarding liquidity providers in VelocityAI pools.

Staking $VAI boosts LP rewards and redeems voting rights in the VelocityAI DAO. Prolonged staking with or without locking of $VAI boosts LP returns further. Stake your $VAI.

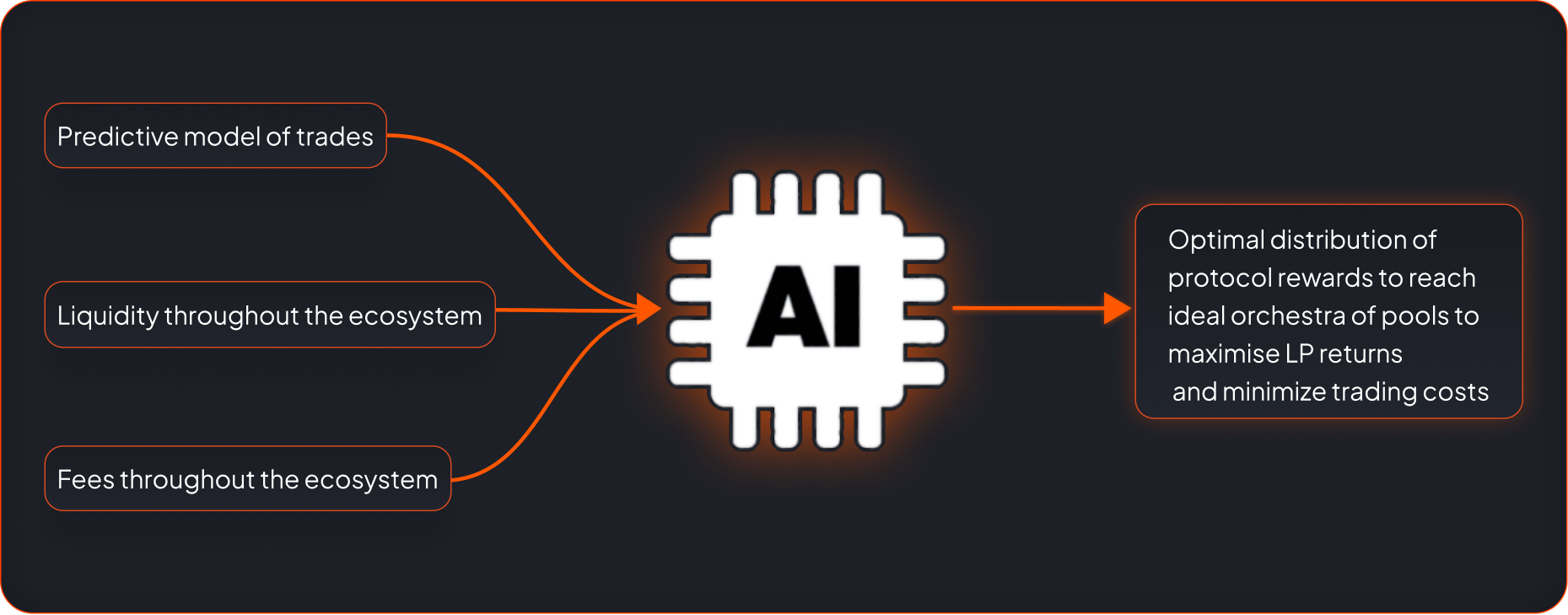

The Minerva AI-engine uses state‒of‒the‒art optimization methods and predictive models to determine pool rewards. Its aim is to drive liquidity where it's most needed, with the dual objectives of maximizing LP returns and minimizing trading costs.

Do you provide liquidity for pairs involving smaller assets as a liquidity provider? Or perhaps you're a trader who regularly trades in altcoins outside the top 5? VelocityAI is designed for you.

Liquidity providers can yield up to 400% higher returns on their capital, with traders benefiting from up to 50% savings on trades.

In fact, VelocityAI 's capital efficiency for 99% of assets far exceeds any other offering on the market.

Groundbreaking Financial Engineering

Learn more about our revolutionary financial technology

Revolutionary AI Agents

Roadmap

H1 2024

-

H4 2024

- Development

H4 2024

- Mainnet launch on Polygon and first Minerva AI agent

H1 2025

- Expansion to additional blockchains and liquidity bootstrapping

H2 2025

- Deployment of a full suite of AI agents

VelocityAI is backed by

Our Partners